Cmon, Do Something…

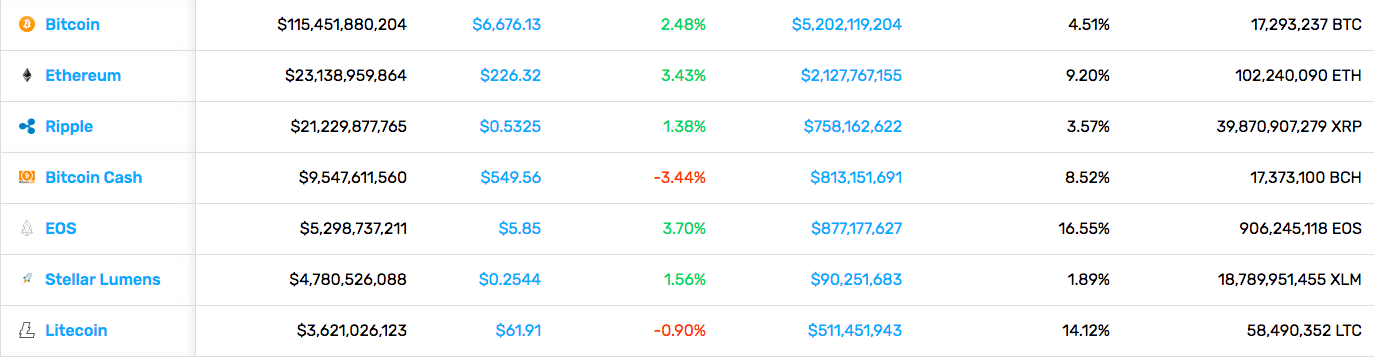

We had a relatively uneventful week in the market, price-wise. The total market cap fell to a low of around $206B in the middle of the week before rising to $221.1B today – an overall loss of about 2% over the week timeframe.

This lack of price movement came on the heels of almost no significant news. So, we shouldn’t be that surprised. Although, on weeks like this, it’d be nice to see prices trend in the other direction. Let’s check in on the top three coins.

Bitcoin had the best week, only losing 1.01% of its value.

Ethereum continued its weekly price drops (albeit a much more bearable one) with a 1.60% loss.

After a phenomenal run last week, XRP finished this week as the big loser, posting a 3.83% price drop.

Bye Bye Blockchain Ban: Oh happy day! Google announced this week that their blanket ban of cryptocurrency-related ads will end in October. The updated policy doesn’t mean it’ll be an advertising free-for-all, however. Advertisements for ICOs, wallets, and trading advice are still on the blacklist, and approved ads can only run in the United States and Japan. Following Facebook’s lead, crypto-related companies need to fill out an application to advertise their products or services.

Walmart Tells Suppliers, “Blockchain or Bust”: On Monday, Walmart informed partners that California-based produce suppliers need to join their supply chain blockchain system or lose their business. The move to blockchain produce tracking should help Walmart reduce the scope of recalls in cases of contamination. Walmart’s Vice President of Food Safety Frank Yiannas told reporters that Walmart has been piloting blockchain technology for two years, so the requirement “shouldn’t really come as a surprise.”

It’s likely that this requirement won’t stop with just produce either as Walmart’s pilots have been going well. Hopefully, other food-based supply chains will jump on board as well. Looking at you, Chipotle.

Crypto Leaders Meet with Capitol Hill Heavies: More than fifty participants joined a roundtable discussion hosted by Rep. Warren Davidson, R-Ohio, on Tuesday to discuss the future of the cryptocurrency world. A key point made was that the weight of regulatory uncertainty will stifle innovation as companies will be afraid to overcommit resources to commit legal infractions due to the misinterpretation of laws.

Additionally, participants criticized the application of the “Howey Test”, a 72-year-old securities law, to digital currencies. SEC Chairman Jay Clayton previously established a firm position that he does not plan to update the “Howey Test” for cryptocurrencies. Mike Lempres, Chief Policy Officer at the San Francisco-based Coinbase noted, “We all want a fair and orderly market, we want all the same things regulators do. It doesn’t have to be done in the same way it was done in the past, and we need to be open to that.”

Circle Launches Stablecoin (USDC): In perhaps one of the odder trends in the cryptocurrency space, the Boston-based payments company Circle launched its dollar-pegged stablecoin called the USDC. This release follows the launch of cryptocurrency exchange Gemini’s stablecoin (GUSD). While these stablecoins aren’t in direct competition as they will likely only be native to each exchange (Circle = Poloniex), they are projected to carve away some of the market share from the stablecoin leader Tether (USDT).

Media Roundup

These stories don’t exemplify groundbreaking adoption, but they do show the small ways in which Bitcoin (and blockchain) continues to enter the mainstream.

I’d Like to Phone a Friend: Bitcoin and blockchain made an appearance on the Australian version of the popular game show Who Wants to be a Millionaire.

Collectible Crypto Bobbleheads: The Los Angeles Dodgers introed over twenty thousand fans to Ethereum this week with digital collectible bobbleheads at their matchup against the Padres.

B.I.T.C.O.I.N (11 Points): Scrabbleheads rejoice. Bitcoin is now officially in the Scrabble dictionary.

Elkrem Allows the Creation of Blockchain IoT Devices: Elkrem brings together the worlds of IoT and cryptocurrency. Learn how here.

Video Game Careers Accelerate to Hyperdrive with Cryptogames: You can now earn some side cash from your couch in your PJs thanks to cryptogames.

NSA Tools Used to Unleash Crypto Mining Malware by Hackers: Whoops! A leaked NSA exploit is making it possible for hackers to mine crypto using your computer. Someone’s getting fired…

[thrive_leads id=’5219′]

The Advantages of Blockchain Beyond Speculation: Yeah, When moon? memes are cool. But have you ever thought about all the other types of value blockchain brings?

A Guide to the UK-based Indacoin Cryptocurrency Exchange: Indacoin is Indahouse. We give you the low-down on this UK-based exchange with fiat conversions.

Ikigai Founder Travis Kling on Cryptocurrency Hedgefunds, ICOs, and More: Complicated name. Simple mission – better crypto asset investments.

How Venezuela’s National Cryptocurrency is Working: Six months after launch, we take a look at how the Petro is holding up. Spoiler alert: Not well.

A Beginner’s Guide to Stellite: A dive into the nitty-gritty of a lesser-known privacy coin, Stellite.

Bitmain’s IPO: Looming Threats and Insights from a Bear Market: Does Bitmain IPO still hold water in the midst of a bear market? Let’s find out.

Austria Notarizes Bonds with Blockchain: Say “Auf Wiedersehen” to traditional databases. Next Tuesday, the Austrian government is planning to issue 1.15 billion EUR worth of bonds in an auction to the public. Following the issuance, the government will notarize data from the bond auction onto the Ethereum blockchain. It looks like this won’t be the last we see of blockchain in Austria either.

Finance Minister Hartwig Löger proclaimed during the announcement that “blockchain technology is an economic policy focus for us, and with the establishment of the FinTech Advisory Council in the Ministry of Finance, we are developing strategies to help Austria make the best possible use of these developments.” Thanks, Google Translate!

Bitmain IPO Takes Some Flak: The Bitcoin mining and ASIC miner juggernaut Bitmain released its IPO prospectus to the Stock Exchange of Hong Kong and showcased strong, but weening growth. Concerns started to arise from the looming threats of a bear market and Bitmain’s depreciated holdings of cryptocurrencies.

Swiss Crypto Bank Raises a Cool Hundred Mil: The Zug-headquartered Seba Crypto AG claimed to have raised 100 million Swiss francs ($104 million) from private and institutional investors to become one of the world’s first regulated banks that allowed for a simple exchange of dollars and euros into cryptocurrencies. The Swiss financial services company is run by ex-UBS Group AG bankers. The launch of the venture hinges on approval of a banking license from the Swiss financial regulator, Finma, and the team plans to submit a license application by the end of October.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.